It is not only high balances on credit cards that can cost us dear. Even organised money fighters can get caught out by transactions made using their ‘stand-by’ credit card if they don’t follow a few rules… A second card is a good idea. There are always occasions when your first card can’t be used. It isn’t just that you might have maxed it out – see the example below. Money fighters always have a back up plan. But while the direct debit (DD) for our usual card choice is paid as normal the other card payment can so easily […]

Don’t get burned by too high energy bills – move!

Figures out today show that more than 600,000 households changed electricity supplier in November 2013. The figure fell back to 390,000 in December, which is not surprising. The time it takes to change energy supplier (electric or gas) supplier is still stuck stubbornly at a lamentable three weeks despite a commitment from the Government that customers should be able to change in 24 hours. If your energy bills are too high during this relatively mild winter, changing company may help. But first and foremost you need to make sure you are on the best tariff. Too many people are still […]

Loans situated next to the baked beans are totally indigestible

If you think you may need a loan to help ease you through the coming months – be on your guard. Money fighters don’t reach for the first brochure the drops through the letter box, or which beckons enticingly from the conveniently placed leaflet stand at the supermarket checkout. Such deals offered by well known supermarket brands heavily promote low rate personal loans for customers. Rates as low as 4.7% are shown in large type and in bright colours. But check out the small (and by small we mean tiny) print. If you fail to do so and simply send […]

Why we’re publishing on January 20, 2014

January 20 is Black Monday – the most depressing day of the year. This year it is probably gloomier than ever but we aim to change that. S0, even though… the Christmas bills have come home to roost gas and electricity costs have gone up and inflation is staying stubbornly higher than pay rises in fact family income is estimated to be £1,200 a year lower than it was five years ago, help is at hand. Money Fight Club will help you to get your finances fit, to see off the bullies that rip you off and to make you […]

Train pain

More trains cancelled! And on the same day that the rail companies detailed their inflation-busting price rises for next year. The average increase is 2.8% compared to the inflation rate of 2.1%. And, coincidentally, it was the same day that Southern Railway sent out vouchers to those who suffered appalling delays and cancellations due to storms and delays in October. Every passenger delayed by the cancellations should claim for the disruption. Monday December 23 saw many train lines closing down for hours and on Christmas Eve they still have not going again. The compensation paid for having no trains at […]

Watch out for water companies raining on your parade

A household I know received a letter from the water company saying it was going to change the direct debit is deducted from their account from December 2013 but nothing else other than an ‘opening balance’ of £17.04. It gave no meter reading, history of payments, no details of standing charges or even what the current payments were. The family had to check their bank account to realise the direct debit payments were being doubled! And as the supply of water and waste water drainage were provided by two different water companies, they then had to check the second company […]

Attacking household bills

Next to buying food, household bills, such as gas, electric and phone rental – are where money fighters hone their skills. This is because they come thick and fast. You probably only renegotiate your mortgage every few years but you have monthly, possibly weekly opportunities to punch above your weight around the house. Plus this is where really big companies can get the better of us if we’re not ready to fight back. They come into our home (via the letter box) and con us – and that’s plain wrong. It’s even more galling because what we’re dealing with here covers […]

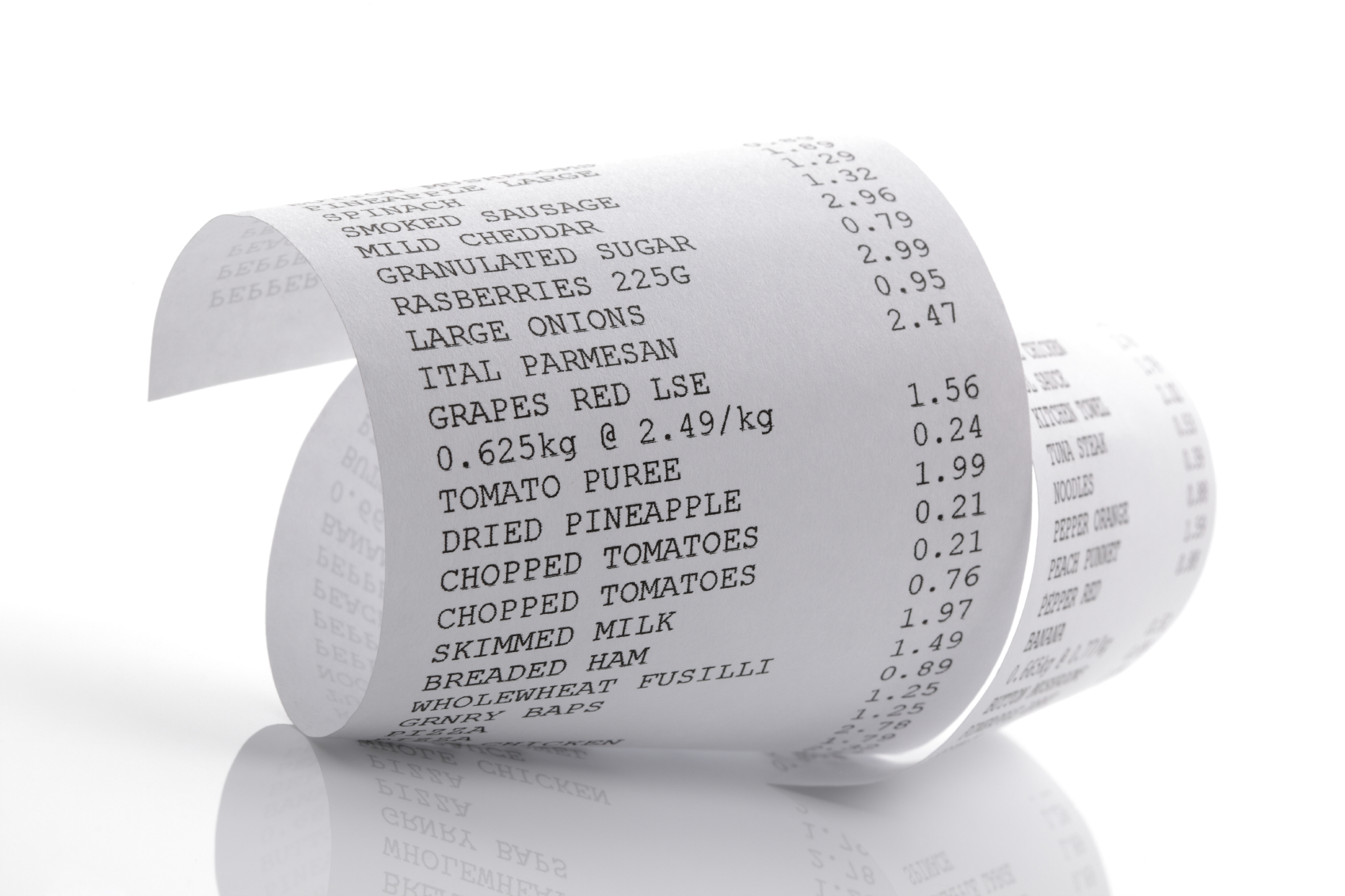

Price hunting

Horsemeat scandal aside, the biggest thing that drives our food shopping tactics is the need to keep within an overall budget and the most recent UK recession has taken its toll in this respect. Figures from the Office for National Statistics in April 2013 showed food sales down by over 4% compared with the previous month and nearly the same amount down year on year. The cold weather hit so-called summer foods but people were also pinching pennies from the table as the long winter and rising fuel prices hit their energy bills. Food prices have also been steadily increasing. […]

Your rights – adding extra punch

Your rights sit at your strong right hand and help you land a tougher punch. Quoting the law, showing you know who a particular industry’s regulator is and demonstrating you can find your way around both internal and external complaints’ procedures will make most companies break out in a cold sweat. At the time of writing an overhaul of consumer law has been promised but in the meantime there’s an assortment of existing legislation, as well as regulators – not to mention the option of pursuing a small claim through the courts. But you need to take a strategic approach. […]

Get Money Fight Club Fit!

[av_dropcap1]O[/av_dropcap1]pen up your paper or turn on the news on any given day and somewhere between the latest celebrity indiscretion and the football scores you’ll invariably find a financial scandal of one type or another. It will involve a company you have a relationship with or, at the very least, have definitely heard of. It will be a brand name you recognize, a mainstream financial sector, such as banking – or an essential, such as heating or food. It will involve smartly dressed, well- heeled people who’ve apparently engaged in a degree of monetary shenanigans that a cowboy builder might […]